Recent Articles

· There are a number of key principles common to every successful management buyout – one that meets your requirements, but also provides a strong basis for future performance. To maximise your probability of success, critically assess your business against, and align your actions with, these golden rules. #1 – Build a quality management team Step 1: Find the right people to buy out the company Properly selecting the co-shareholders who will take over the business is a critical step in the buyout process. “It’s a little like a marriage,” Drouin says. “Everyone has to share the same values and vision.” He also stresses that they all have to be entrepreneurially minded · A smooth management buy-out is pretty self-explanatory, according to Manson. “A successful MBO should provide a smooth transition period with minimal disruption to the company’s operations, be they customers, its supply chain or its own staff. Ultimately, the business continuing to prosper and grow is the acid test for success.” Next Post

Showcasing the Best of Welsh Business

Step 1: Find the right people to buy out the company Properly selecting the co-shareholders who will take over the business is a critical step in the buyout process. “It’s a little like a marriage,” Drouin says. “Everyone has to share the same values and vision.” He also stresses that they all have to be entrepreneurially minded · There are a number of key principles common to every successful management buyout – one that meets your requirements, but also provides a strong basis for future performance. To maximise your probability of success, critically assess your business against, and align your actions with, these golden rules. #1 – Build a quality management team An introduction to management buyouts | blogger.com

How is an MBO Undertaken?

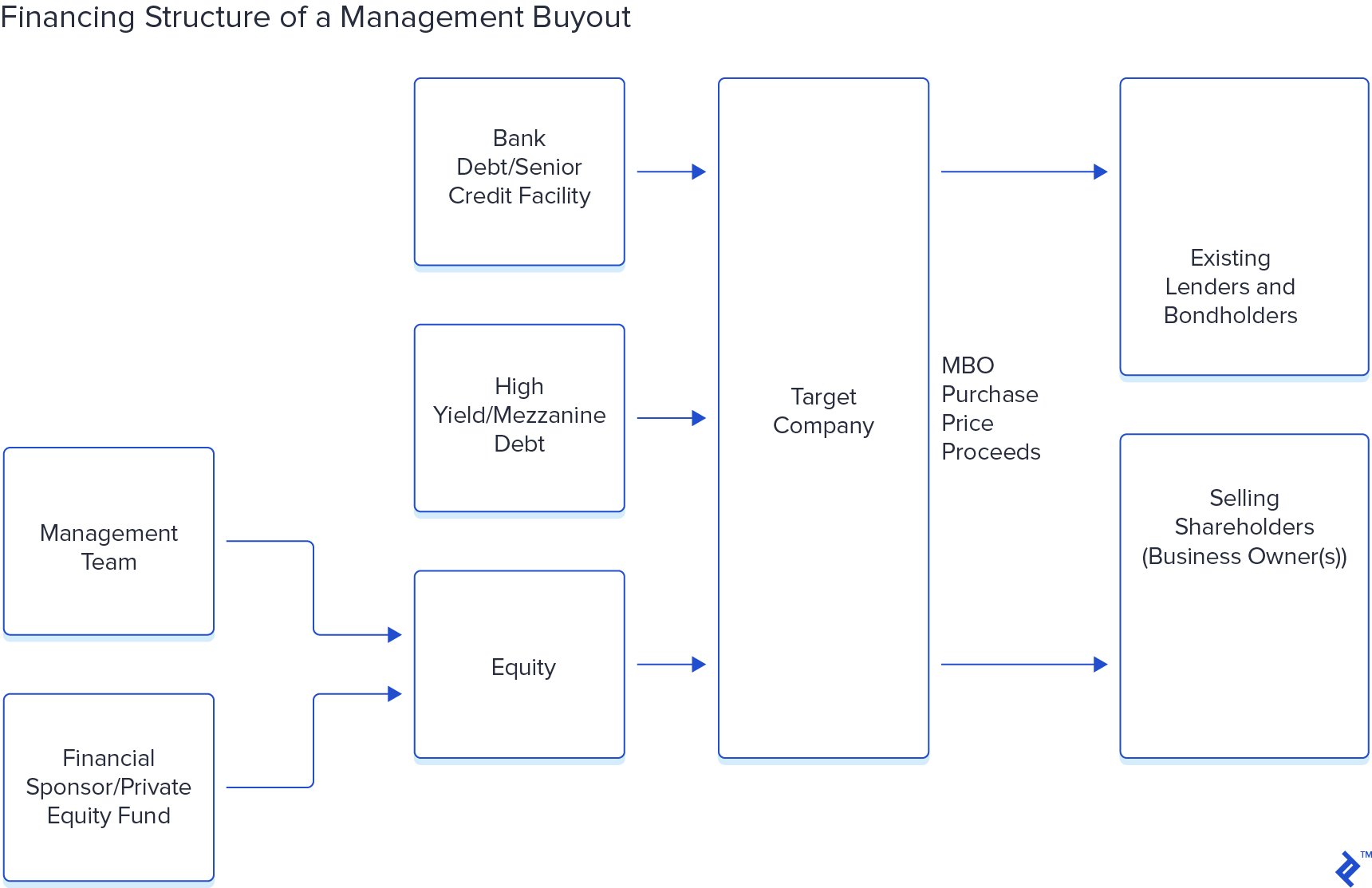

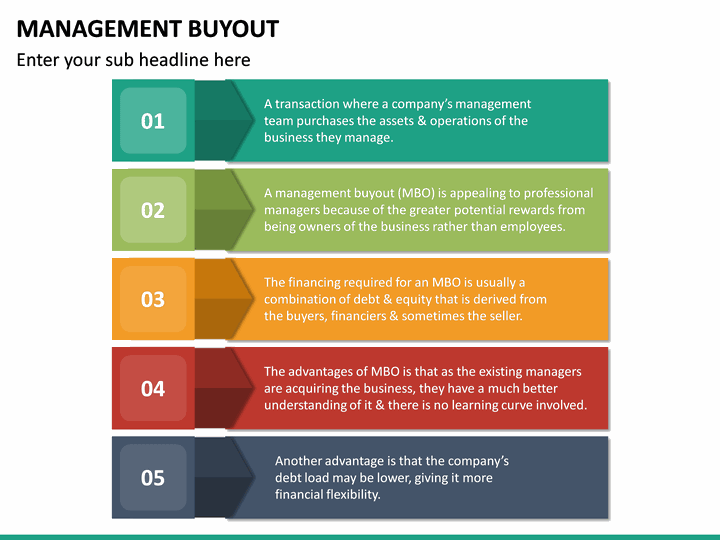

In its simplest form, a management buyout(MBO) is a transaction in which the management team pools resources to acquire all or part of the business they manage. MBOs can occur in any industry with any size business. They can be used to monetize an owner’s stake in a business or to break a particular department away from the core blogger.comted Reading Time: 9 mins · There are a number of key principles common to every successful management buyout – one that meets your requirements, but also provides a strong basis for future performance. To maximise your probability of success, critically assess your business against, and align your actions with, these golden rules. #1 – Build a quality management team Management Buyout Funding is where one company is willing to buyout another company for the benefit of both companies. Usually Management Buyout Funding is provided by entities, either in debt or equity so that the company buying out the other has enough capital to purchase the existing company as well as operating cash. The Problem

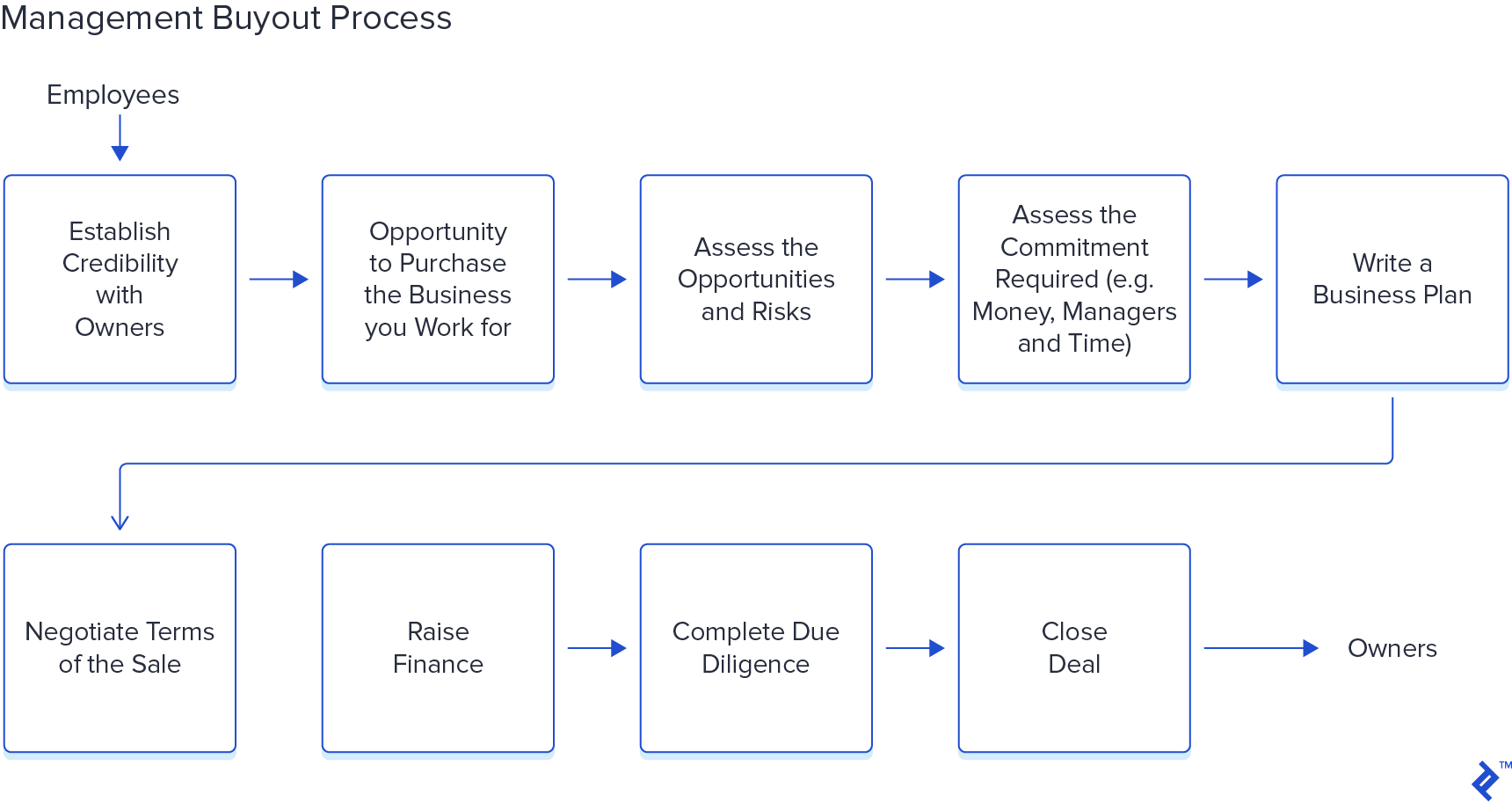

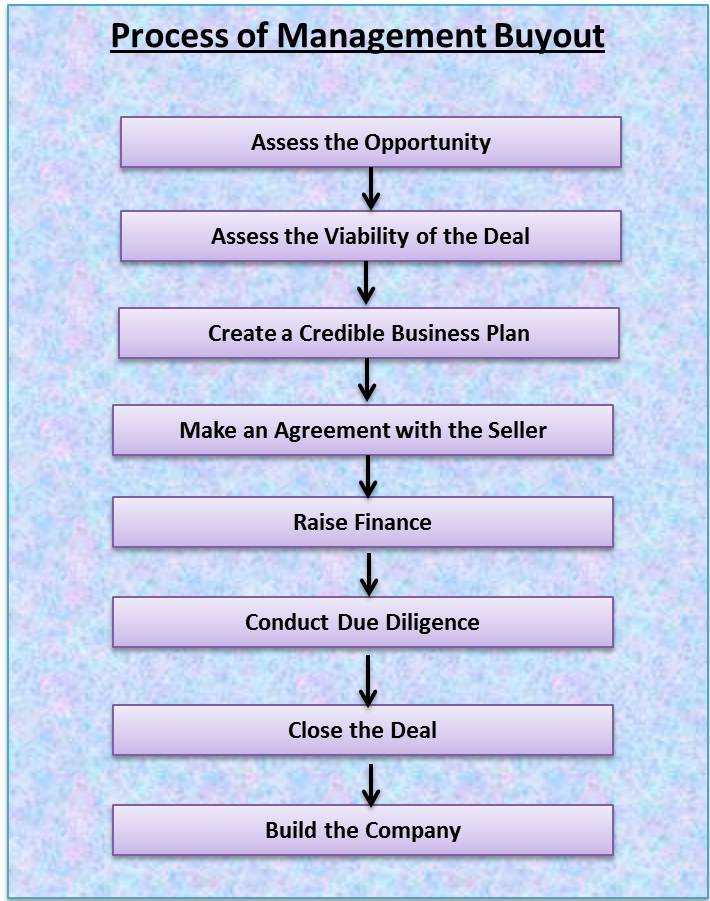

What is the Management Buyout Process?

In its simplest form, a management buyout(MBO) is a transaction in which the management team pools resources to acquire all or part of the business they manage. MBOs can occur in any industry with any size business. They can be used to monetize an owner’s stake in a business or to break a particular department away from the core blogger.comted Reading Time: 9 mins · If you are considering buying, you should give thought to the following: 1. Build your experience and position yourself to be an owner – you will need to build a rapport with both the management and the employees of the company early on to prove that you are capable of running the company Step 1: Find the right people to buy out the company Properly selecting the co-shareholders who will take over the business is a critical step in the buyout process. “It’s a little like a marriage,” Drouin says. “Everyone has to share the same values and vision.” He also stresses that they all have to be entrepreneurially minded

DEFAULT GROUP

In its simplest form, a management buyout(MBO) is a transaction in which the management team pools resources to acquire all or part of the business they manage. MBOs can occur in any industry with any size business. They can be used to monetize an owner’s stake in a business or to break a particular department away from the core blogger.comted Reading Time: 9 mins · There are a number of key principles common to every successful management buyout – one that meets your requirements, but also provides a strong basis for future performance. To maximise your probability of success, critically assess your business against, and align your actions with, these golden rules. #1 – Build a quality management team An introduction to management buyouts | blogger.com

No comments:

Post a Comment